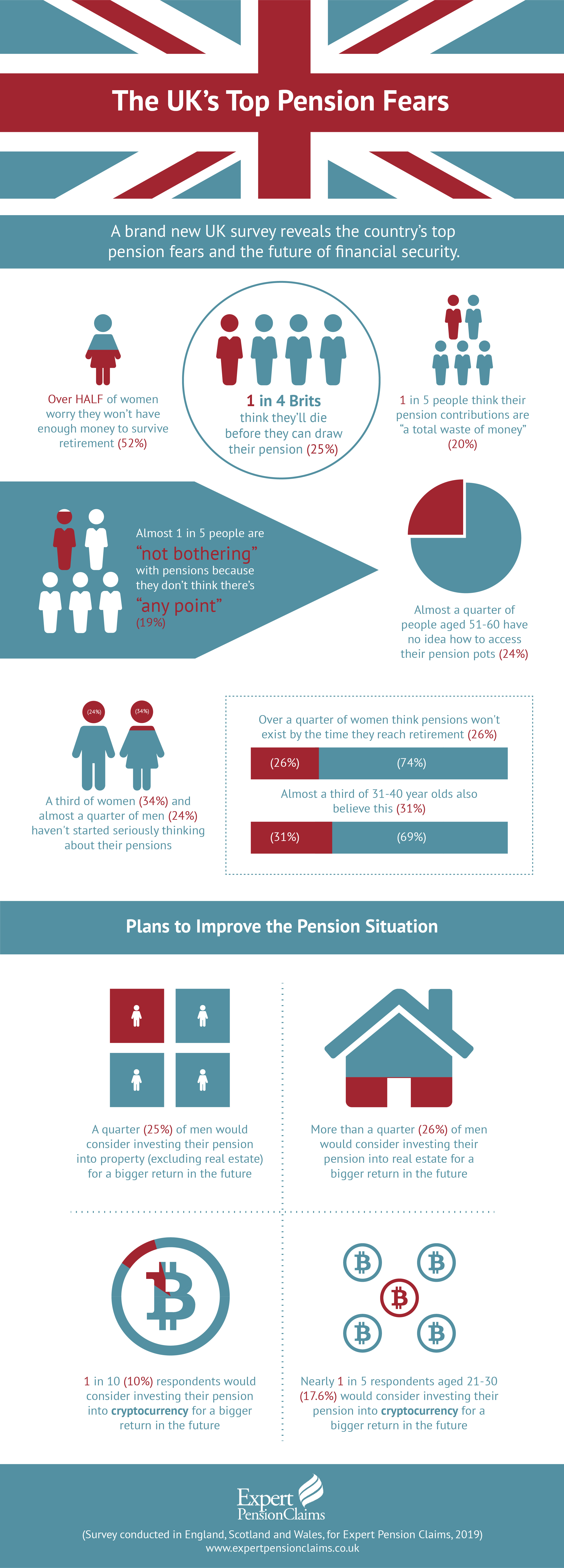

The Expert Pension Claims team recently commissioned a nationwide survey to get a deeper insight into the UK’s relationship with their pension and the pension system in general. The survey was carried out using 2,000 adults across the United Kingdom and delivered some quite interesting perspectives. There were things we expected to find, and more than a few things we didn’t. We’ll start with the latter.

Almost half of all 51-60-year-olds worry that they won’t have enough money to last through retirement

After a lifetime of saving, at practically the final hurdle, 48.30% of all 51-60-year-olds worry that they won’t have enough money to last their retirement. This is what struck us the most. Our pensions system is there to provide more than just peace of mind – it’s our reward for a working life and the assurance that we’ll be taken care of once we reach pension age.

However, what this suggests is a below-par understanding of how much an individual might pay into their pensions (and, one could argue, the kind of lifestyle they might want to live during retirement). This evidence supports the argument that many in the UK would benefit from being a little more pension-savvy – with a greater understanding and more preparation, there should be little reason why people in the UK should feel this way (certainly not so close to the pension age).

However, as we’ve said, it suggests inadequate preparation as well as a little uncertainty (and even scepticism) regarding the pension system – as these findings indicate.

25% of both men and women don’t believe that pensions will exist by the time they retire

Another thing that surprised us, although it perhaps shouldn’t be given the current uncertainty surrounding Brexit. It seems our age is defined by uncertainty, particularly for those who have not been paying into a pension scheme very long. With a lifetime ahead of you, and in such uncertain times, who really knows what might happen by the time retirement age comes around?

Are pension investments the answer to the UK’s pension fears?

With this much uncertainty and scepticism, it’s no wonder that large parts of the UK population turn to pension investments to cement their future financial standing. There is a vast range of pension investments out there, many of which are sold as alternatives to the UK workplace pension.

They often come with tempting benefits and ROIs that seem too good to be true. The thing is, they often are. We’ve written at length on how to tell if you’ve been mis-sold a pension product which should help safeguard you against mis-selling.

How to claim for a mis-sold pension

In these strange and uncertain times, people are putting themselves at risk of pension mis-selling because they’re becoming warier of the effectiveness of workplace and state pensions.

It’s understandable that people want to look for alternative ways to secure their future, but it absolutely should not put that future in jeopardy. If you think that this may have happened to you, or maybe you are in the middle of a transaction and are beginning to think twice, get in touch with our pension claims experts.

We have a team on-hand and available to talk to you today, so give us a call.