It’s a sad fact of life that thousands of people around the country are still being scammed out of their hard earned savings for retirement, despite the pension reforms that have taken place. That number is probably set to rise as well.

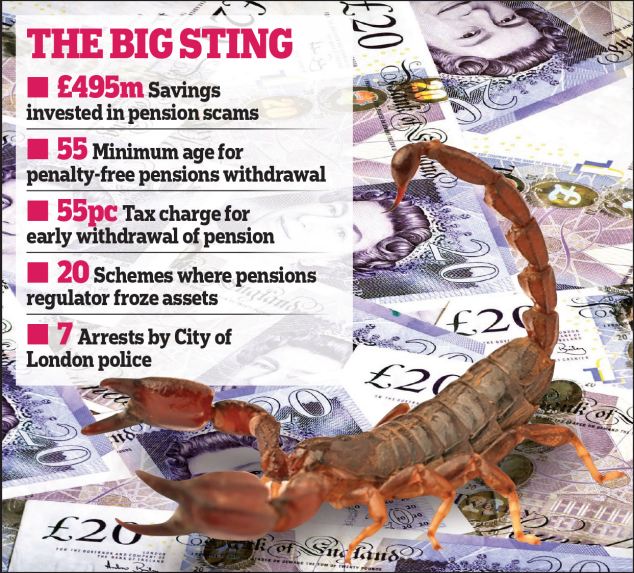

Where a lot of this is happening is where the over 55s are targeted by pension liberation scams where they will get duped out of their savings. These cases have in fact doubled in size over the last 2 years, with estimated losses in the UK of around one and a half billion pounds.

Please don’t become a victim of a pension scam.

As we have previously discussed on our blog, the pensions minister Baroness Altmann wants pension companies to start treating customers a lot better, however she doesn’t seem as committed to stopping pension scams themselves. In fact, she went so far as to say that it was not on the current agenda for the UK Government to legislate and come down on scams.

What makes the situation even more worrying for UK savers coming towards their retirement is that a recent High Court ruling which overturned a decision by the Pensions Ombudsman. The decision then went in favour of insurer Royal London regarding a very suspicious money transfer to a SSAS (small self-administered scheme) in 2014.

A common view with finance experts specialising in the mis-selling of pensions and investments is that this ruling, combined with the Pensions Advice Service and Pension Wise being abolished could mean that scammers and bad advisers could have more opportunity to defraud innocent people.

As worrying as it sounds, our advice to anybody interacting with a pension’s advisor is to really be very vigilant. We recently set out some steps you should take in order to reduce the risk you could be in – for more information on that read up on how to help safeguard yourself against bad investment advice.

In very simple terms though there are a few things that you should look out for. Here’s a quick few tips of things you should be aware in order to help reduce the risk in being a victim of a mis-sold pension plan.

Where the advisor tells you “there will be no tax to pay” – this is not true, as if you withdraw any money before the age of 55, you will have to pay a significant amount in tax. You might also be told that the deal they are trying to sign you up to is on a “limited availability” and you need to transfer all the funds today. This is a massive warning sign and we would advise that you walk away: quickly.

Now, thankfully at Expert Pension Claims we have a roster of specialist team who are helping victims of financial mis-selling each and every day. If you would like us to represent you, or just want some free advice on where you stand and your legal option then please call us immediately.